FSI is an essential part of the complex web of real estate development and investment in a city like Mumbai, where space is limited and highly valued. Floor Space Index (FSI), also known as Floor Area Ratio (FAR), is a legal tool used to determine the maximum amount of development permitted on a particular plot of land. However, you may be asking yourself, in Mumbai real estate dynamics, what FSI is.

In the highly crowded metropolitan region of Mumbai, where land is in great demand, FSI becomes an important factor to take into account to maximise land utilisation. Real estate developers are obligated to make sure that constructions stay within preset parameters by following the stated FSI regulations imposed by the appropriate municipal authorities.

For residential buildings, what is FSI?

The Floor Space Index is a crucial factor in real estate and construction, as was previously noted. The maximum floor space that a developer is permitted to utilise for building on a piece of land is known as the Floor Space Index. This shows the proportion of the planned building’s built-up area to the plot’s total amount of available land. The maximum floor area that a developer is permitted to use is mostly determined by the policies of the local government and varies from state to state. The computation often depends on several other variables, including the building type, plot size, and location.

Influence of FSI on Mumbai’s Urban Development

1: Financial Growth

The average FSI in the city has been comparatively high over the last several decades, which has piqued real estate developers’ interest in investing in Mumbai developments. As it enables developers to maximise investment returns by increasing development density. Due to the increased demand and investment, Mumbai’s economy has grown significantly, contributing to the city’s real estate market and by creating employment opportunities.

2: Residential Options

The fact that there are now more housing alternatives in Mumbai’s real estate market is one of the FSI’s most significant implications. Due to the relatively lax FSI regulations in several areas of Mumbai, developers have constructed larger sites that can accommodate more residential units. This has significantly contributed to expanding the variety of housing alternatives in the city and provides a greater range of possibilities for house purchasers with different income levels.

3: Infrastructural Developments

Due to the city’s comparatively high FSI allowance, there have been more building development projects, which have also opened the door for several infrastructural upgrades. An increase in residential and commercial building projects has resulted in advancements in transportation, public facilities, and social infrastructure, among other infrastructure features.

Calculation of FSI in Mumbai

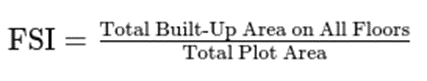

The following formula is used to determine FSI in the city of Mumbai:

Broadly speaking, several factors, including population density, area growth patterns, density of buildings, and distinctive features of the region influence the FSI limit. The value of the financial FSI number can also be greatly impacted by the kind of land—residential, commercial, or industrial. Low FSI barriers will limit real estate growth as they make larger-scale construction more difficult, even though FSI is seen as being a crucial driver in Mumbai’s growth.

FSI for Redevelopment Projects

When it comes to Mumbai’s reconstruction initiatives, Floor Space Index is essential in helping to renovate the city’s older, more dilapidated structures. The authorities essentially increase the FSI limit to encourage developers to start redevelopment projects, primarily to maximise land usage and better serve the city’s rapidly expanding population’s housing demands.

You may be thinking about how to figure out the FSI for a Mumbai redevelopment. The process of calculating FSI for redevelopment involves many steps:

- Determining the total extent of the land plot that the property is located on is the first stage.

- Next, ascertain the extent of the existing built-up area, taking into account any existing structures on the land. For the uninitiated, the existence of common spaces is the primary distinction between built-up and super-built-up areas.

- By multiplying the plot’s present size by the FSI specified by the DCR, one may find the new allowed built-up area.

- The additional built-up area that can be constructed is obtained by deducting the initial built-up area from the total figure.

- The final FSI for the new additional built-up area is obtained by dividing the additional built-up area by the land size.

FSI for Residential Building in Mumbai

As previously stated, the location and—above all—the kind of building are the primary determinants of a property’s FSI. The FSI assigned to commercial or industrial buildings is often different from that of residential structures. Residential building FSI in Mumbai usually falls between 1 and 1.33. In certain places, the residential FSI can even reach 2.5, however these are usually reserved for rehabilitation projects. In Mumbai’s suburbs, the FSI is often higher—it can even approach three or four.

FSI for Commercial Building in Mumbai

The FSI for commercial buildings in Mumbai is often in the range of 1.33 to 3. Additionally, similar to its residential counterpart, the business FSI is typically higher sometimes as high as 5 in the suburbs.

What Effect Does Residential FSI Have on Mumbai’s Housing Cost-effectiveness?

The quantity and kind of dwelling units that developers will construct for their residential developments are greatly influenced by the official residential FSI. In a city like Mumbai, where there is a high demand for housing alternatives and a subpar supply, which directly affects the city’s real estate market, this becomes an even more important factor.

A greater FSI, as we already know, allows for the construction of more residential units on a given piece of land. As a result, in addition to increasing the number of housing alternatives available, this scenario would also cut rates and improve the area’s overall affordability.

Conclusion

The Floor Space Index (FSI) is still a crucial component of urban planning and real estate development, particularly in Mumbai. When attempting to negotiate the intricate and varied world of Mumbai real estate, having a solid grasp of how FSI operates and how it affects other aspects of real estate gives one a significant advantage. Respecting the FSI requirements is essential for developers, and it’s also critical for real estate investors to confirm that a property complies with these regulations before investing.